Climate Finance and the Marshall Islands: Options for Adaptation

To cite: Sancken, L., Jayawardhan, S., and Wheeler, B.L. (2021). Climate Finance and the Marshall Islands: Options for Adaptation. Policy Brief of the Marshall Islands Climate and Migration Project. University of Hawai‘i at Mānoa. Available at www.rmi-migration.com

Read author Lauren Sancken’s article, The Price of Sovereignty in the Era of Climate Change: The Role of Climate Finance in Guiding Adaptation Choices for Small Island Developing States, in the UCLA Journal Of Environmental Law & Policy, which, in part, informs this brief.

Introduction

The integrity of the Republic of the Marshall Islands (RMI)’s physical territory is at risk due to the impacts of climate change. The atolls of the RMI are only a few meters above sea level, and increasingly frequent storms, drought, and severe weather events may render them uninhabitable [1] without immediate and long-term adaptation strategies. The RMI, like other small island developing states (SIDS), must choose and design effective adaptation options, as well as navigate how to finance them when the cost exceeds their financial means. Therefore, they require “climate finance,” dedicated funding to address the impacts of climate change.

Source: Kees van der Geest

This brief describes the adaptation options the RMI may consider and the finance available to support those choices. Part One describes potential Adaptation Choices, focused on the Preservation of Existing Islands, Construction of Artificial Islands, Planned Resettlement, and further Legal and Political Options that may arise through the Compact of Free Association (COFA) and other possible regional agreements. Part Two outlines Climate Finance Mechanisms in more detail, providing a Climate Finance Overview, a focus on Climate Finance and SIDS, and finally a discussion of The Role of Climate Finance in the RMI. The Conclusion discusses the possibility of a multi-part strategy: investing in measures to preserve island habitability, taking steps to advocate and attract financing for long-term adaptation measures, and negotiating to secure political and legal rights through existing or new agreements.

Adaptation Choices

If the RMI loses its habitable territory, its current population will be displaced. No single overarching legal framework exists for climate-displaced persons, and although the RMI and the United States have a Compact of Free Association (COFA) that allows for non-visa migration to study, live, and work in the United States, [i] residents of the RMI do not have another affirmative source of legal protection or financial support to relocate elsewhere. While roughly a third of the Marshallese population currently live in the United States, this should not de-center the desire that most Marshallese have to maintain the habitability of the RMI and stay in or return to their home country. Both migrating from and remaining on the islands of the RMI have consequences for the preservation of Marshallese culture and ways of life.

For these reasons, adaptation options that preserve existing territory in the short term must be explored even while strategizing around other adaptation responses like resettlement. The adaptation options discussed below highlight some of the potential solutions available to the RMI, including those which the country has prioritized thus far.

Preservation of Existing Islands

Stabilizing the habitability of existing islands would be the least disruptive adaptation option available to Marshallese citizens. It maintains the RMI’s traditional sovereign rights to its territory, avoids the perils of displacement, and increases the likelihood that the Marshallese can maintain their existing communities and economic practices. In fact, selecting islands to raise and build upon has already been discussed as a centerpiece of the RMI’s climate response. [ii]

One manner of maintaining existing islands is to construct coastal defenses around their perimeters, elevating and protecting them from sea-level rise and erosion. Elevating an island by reclaiming land relies on a familiar engineering practice called “dredging,” a means of siphoning water and sand from a body of water to use as sediment in a different location. [iii] Elevating an existing island also conforms with the UN Convention on the Law of the Sea (UNCLOS) definition of an “island,” [iv] thus maintaining the RMI’s existing rights under the convention. To protect existing or elevated islands, coastal defenses like seawalls can be built, limiting the impacts of erosion and storm surges. [v]

The estimated cost of a temporary seawall to protect one of the RMI’s atolls is USD $100 million, an amount nearly double the country’s annual revenue.vi The Intergovernmental Panel on Climate Change (IPCC) acknowledges that this cost is “well beyond the financial means of most small island states.” [vii] In addition, seawalls must be maintained to be effective, and will likely need to be built both higher and wider over time to prevent erosion. [viii] These types of coastal defenses attract climate finance particularly when a country specifies their need in a National Adaptation Plan of Action (NAPA). [ix] For instance, the RMI specified the need for climate adaptation infrastructure in its NAPA, and the Green Climate Fund (GCF) subsequently funded a USD $44.1 million project to enhance “the resilience of coastal infrastructure in the densely populated areas” of the RMI. [x]

Images of various attempts to keep the sea at bay, taken by Kees van der Geest during research in the Marshall Islands in 2017, with coordinates of their locations noted where known. From left to right: Image of partial wall likely taken at 7.073111959704288,171.31350971122552, image of family in boat taken at 7.123171179498123, 171.3572352343214, image of the wall that runs alongside the airport, and image taken from the Marshall Islands Club, looking west, at 7.110460200218629, 171.37147780998708.

Construction of Artificial Islands

Constructing artificial islands is another adaptation measure the RMI may consider. Artificial islands can be constructed in existing territorial waters, allowing the retention of the RMI’s traditional sovereign status even if its population relocates to such an island. [xi]

Artificial islands have the benefit of being designed to withstand climate impacts—like sea-level rise and erosion [xii]—and to address other issues, such as overcrowding. [xiii] For instance, the Maldives constructed the artificial island of Hulhumale to serve both of these purposes, [xiv] and it is now home to a significant permanent population. [xv] However, the cost of the project was USD $400 million, an amount financed primarily by loans from Saudi Arabia, China, and the United Arab Emirates (UAE).xvi While the World Bank provided a USD $16.5 million grant, the project resulted in significant debt owed to foreign states, which has generated local and international concern. [xvii] Other models of Pacific SIDS engaging in artificial island construction and financing do not exist. Kiribati is reported to have contracted with the UAE and Saudi Arabia to build artificial islands, but these projects do not appear to be underway and lack publicly available cost information.

Because little consensus or data exists on the cost of constructing an artificial island, it is unclear whether this adaptation strategy would be more economically viable than raising existing islands. Some research suggests that creating a new land mass would avoid the high cost of elevating and refitting existing infrastructure. [xviii] However, others have indicated that constructing an artificial island to which the Marshallese can relocate would be expensive, environmentally destructive, or even the “ultimate last defense,” rather than a desirable option for maintaining the close connection between the Marshallese and their islands. [xix]

Planned Resettlement

The RMI could consider planned resettlement as a long-term adaptation option independently, or concurrently with other efforts to maintain its territory. One of the major obstacles to resettlement, besides finding viable host communities, is a lack of available finance for the full cost of a relocation. [xx]

If the Marshallese elect to relocate elsewhere, the resettlement strategies of other SIDS communities may be instructive. For example, in 2015, Kiribati purchased 5,460 acres of land in Fiji for USD $8.7 million as a possible future relocation site for its citizens. [xxi] Outside of this initial land purchase, however, it is not clear how much the actual relocation will cost, as transport, construction of new homes and services, and other essential aspects of the resettlement currently lack identified funding. [xxii] The relocation of a Maldivian community to Dhuvaafaru was mainly funded by a philanthropic group that provided USD $32 million of the USD $45 million needed, but this was in direct response to displacement caused by a 2004 earthquake and tsunami, not a proactive relocation. [xxiii]

Among the Marshallese, Bikinians have recently purchased 238 acres of land near Hilo, Hawai‘i, as both a financial investment and backup plan in the event that they must relocate due to climate change. [xxiv] This option involves an unusual arrangement born of historical legacy, with funding coming from the Bikini Resettlement Trust Fund. The fund was first established in the early 1980s, largely intended for improvements on the islands to which Bikinians were relocated due to nuclear testing (Kili and Ejit), and its initial 25-year term was set with the mistaken belief that Bikini Atoll would again be habitable by that time. [xxv] In 2017, the Department of the Interior granted the Kili/Bikini/Ejit (KBE) government’s request for control over the Bikini Resettlement Trust Fund, which made this land purchase possible. [xxvi

]Existing models of relocations have been self-financed by national governments or independent, designated funding sources. To date, no multilateral funding sources, like the UNFCCC’s Green Climate Fund, have been used to support a planned relocation.

Legal and Political Options

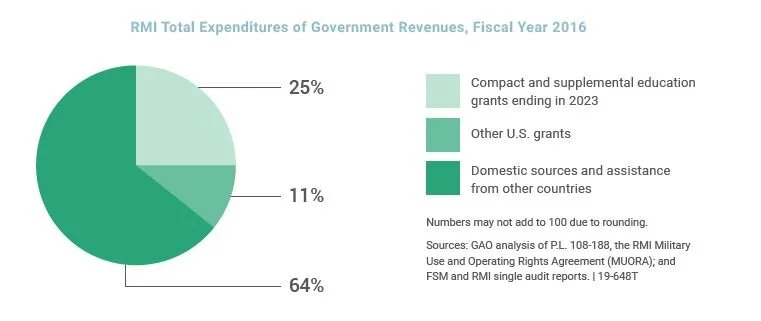

The calculation and analysis of the total expenditures of government revenues of the RMI in 2016, as rendered here, was performed by the U.S. Government Accountability Office, and published in their 2018 report, see reference xxvii. Graphic re-design for this publication by Ryookyung Kim.

Creating and amending bilateral or regional agreements could help the RMI secure its existing rights and expand its adaptation options.

The re-negotiation of COFA between the RMI and the United States is currently underway, in preparation for the RMI’s transition from compact grant assistance to trust fund income in 2023. Some grants and programs are slated to expire in that year, totaling a quarter of the RMI’s expenditures, and the U.S. Government Accountability Office (GAO) reported in 2019 that trust funds are unlikely to completely replace grant assistance. [xxvii] The RMI has created a compact planning committee, and the result of this re-negotiation is very likely to affect the legal and economic support for the country’s infrastructure improvements, as well as its migration decisions. [xxviii]

The RMI could also seek out a different bilateral or regional agreement that could include migration compacts and measures to coordinate international climate adaptation investment. For instance, some Pacific nations, such as the Solomon Islands and Kiribati, have recently established diplomatic relations with Beijing instead of Taiwan, noting that China’s stated commitment to fight climate change is part of their rationale. [xxix] Regionally, the RMI could use its existing role in the Pacific Resilience Program or the Coalition of Low Lying Atoll Nations to build upon existing objectives and advocate for additional legal and financial objectives, or it could create a separate Pacific regional agreement akin to a Free Movement Agreement (FMA) that would facilitate migration in a disaster context and even provide a basis for regional cooperation for financial investment. [xxx]

As the climate signal increases in the Pacific and across the world, the RMI might also further broach topics of reparative justice. This might include leveraging existing principles under international environmental law, such as Common But Differentiated Responsibilities and Respective Capabilities (CBDR-RC). This includes the suggestion that this principle be narrowed and made more actionable through a focus on the colonial relationships [xxxi] that have amplified economic disparity and climate vulnerability, which some argue has disrupted contemporary climate adaptation and its funding in the RMI. [xxxii] Another suggestion is the provision of ‘remedial territory’ for deterritorialization in SIDS, possibly through expansion of the Loss and Damage Mechanism. [xxxiii, xxxiv]

Climate Finance Mechanisms

A variety of financial mechanisms are theoretically available to the RMI for adaptation measures. This section presents an overview of key aspects of the current climate finance landscape, focusing on the availability of finance for projects in SIDS, and the specific role of climate finance in the RMI.

In August 2019, the Asian Development Bank held a conference on Resilient Atoll Nations in Productive Oceans in the Maldives, with participants shown here. [For image and press release on the event, see: https://perma.cc/E4R9-VAVN]

Climate Finance Overview

Climate finance generally refers to local, national, or transnational financing used to support responses to climate change and can be drawn from any public or private source. [xxxv] Global climate finance flows are estimated to be around USD $500 billion annually and are channeled into two main investment areas. The first is mitigation, geared toward significantly reducing global greenhouse gas emissions, and the second is adaptation, which focuses on reducing the adverse impacts of climate change. [xxxvi] Adaptation finance, the investments that concern this paper, represent around USD $22 billion, a fraction of total climate finance. [xxxvii] The remainder is channeled towards mitigation. [xxxviii] By 2030, global adaptation finance needs are estimated to be at between USD $140 billion and USD $300 billion a year, and by 2050, these estimates rise to USD $280 to USD $500 billion a year. [xxxix] In light of these projected needs and current financing trends, adaptation measures continue to face the prospect of being drastically underfunded.

The United Nations Framework Convention on Climate Change (UNFCCC) is the main source of international public financial assistance for developing countries impacted by climate change. In addition to setting out the principle of CBDR-RC among nations, it lays out a series of commitments by which developed countries provide financial resources to developing countries. [xl] The UNFCCC established a Financial Mechanism to facilitate funding through two multilateral operating entities, the Global Environment Facility (GEF) and, as discussed above, the Green Climate Fund (GCF),xli which are the main sources of public climate finance for developing countries. [xlii]

Outside of the UNFCCC, there are several smaller sources for adaptation finance. Climate Investment Funds are pooled, multi-donor trust funds, jointly implemented by development banks and managed by the World Bank. [xliii] Multilateral Development Banks, like the World Bank, act as intermediary brokers between public funds and private investors in order to drive private capital flows into developing markets. [xliv]

Finance can also take the shape of bilateral funding (country-to-country direct investment)xlv or utilize national or regional investment funds. [xlvi] The Alliance of Small Island States (AOSIS), for instance, noted their "four key measures of ambition" [xlvii] at COP25 in 2019, with one directly focused on climate finance goals, and another pertaining to greater support for the Loss and Damage Mechanism. AOSIS, which counts the RMI among its membership, has proposed ideas like insurance pools and collective compensation by high-emitting countries since the early 1990s. [xlviii] It is possible it could be involved in creating a fund for regional adaptation projects that could attract private investment diversified across mitigation and adaptation projects. [xlix]

Private sources of climate finance are emerging and may become a greater source of adaptation funding, [l] particularly if advocacy efforts increase. The Global Commission on Adaptation (GCA), for instance, advocates for an increase in public and private adaptation finance, and former RMI President Hilda Heine is currently one of the GCA Commissioners.li It is unclear what the future role of private climate finance will be on adaptation projects, but pursuing private resources may open up options for projects like artificial islands and resettlement that have yet to be publicly funded.

It bears noting that, while this brief addresses the overall landscape of global climate finance, there are significant challenges in distilling accurate data. While the GCF and GEF publicly report financial data, flows from other sources are often untracked and underreported. [lii] Tracking climate finance to SIDS is particularly challenging for several reasons: adaptation finance is commingled with other sources of development aid, donors often self-report, and data sets aggregate financial flows in ways that obscure the impact on small island states. [liii] For instance, climate finance data tends to aggregate finance to all small island states globally or aggregate data between East Asia and the Pacific, making the impact on Pacific island states nearly “invisible.” [liv]

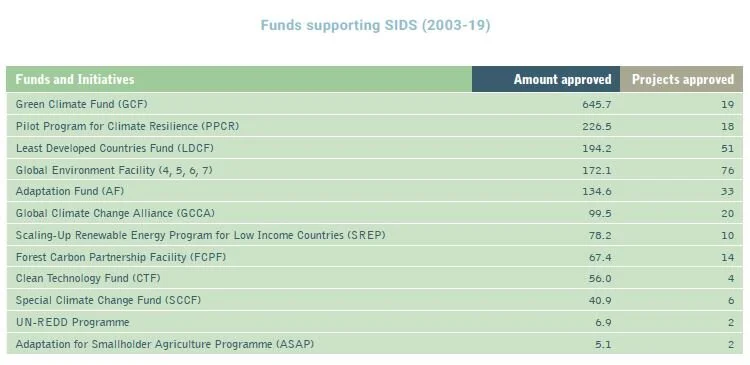

This graphic was first published in the factsheet, GCF spotlight: Small Islands Developing States (SIDS) [Available for download at: https://www.greenclimate.fund/document/gcf-small-islands-developing-states-factsheet]

Climate Finance and SIDS

The GCF is currently the largest source of finance for developing countries and specifically for SIDS, followed by the Least Developed Countries Fund (LDCF) and the Pilot Program for Climate Resilience (PPCR). As of March 2020, the GCF committed USD $5.6 billion for 129 projects in developing countries.lv Of this amount, it approved USD $877 million for 26 mitigation and adaptation projects in SIDS, [lvi] and another USD $47.9 million to assist SIDS with their readiness for project implementation and the design of their National Adaptation Plans (readiness grants).lvii The LDCF, a specialized fund administered through the GCF, approved USD $194 million for projects in 2019. [lviii] The PPCR committed USD $226 million for projects in SIDS. [lix]

Regional variation exists in the amounts received by SIDS. During the 2003-2018 period, Pacific SIDS received USD $791 million, followed by those in the Caribbean (USD $571 million), and the Atlantic, Indian Ocean, Mediterranean and South China Sea (USD $327 million). [lx]

This table, and its original title, comes from the climate finance briefing noted in reference xxxvi.

The Role of Climate Finance in the RMI

As of 2020, the GCF has provided the largest amount of finance to the RMI, with USD $78 million in approved funding across local and regional projects. To illustrate, the GCF approved USD $46.1 million to finance two adaptation projects currently underway in the RMI. [lxi] The first project, approved in 2019 with an expected completion date in 2027, aims to secure the RMI’s drinking water supply against climate risks with approved financing of USD $24.7 million. [lxii] The second project, approved in 2018 with an expected completion date in 2024, will reinforce the RMI’s coastal infrastructure against sea-level rise and storms in the capital Majuro and the island of Ebeye, and increase disaster preparedness and early warning systems throughout the islands, with financing of USD $44.1 million. [lxiii] The GCF also approved a USD $564,000 readiness support grant to the RMI. [lxiv]

The GCF has had a dramatic role in the climate finance available to the RMI since its capitalization in 2015. Prior to the GCF entering the picture, the RMI’s climate finance totaled USD $7.9 million for the 2010-2014 period. [lxv] The GEF was the largest funder before the GCF’s arrival on the climate finance stage, providing USD $3.92 million, and Australia closely followed, providing USD $3.62 million. [lxv]i GCF-approved funding now totals nearly ten times the amount of pre-GCF funding in the RMI.

While the GCF is currently the major source of finance in the RMI as of the date of this brief, the GEF has continued to fund modest, short-term projects. These include (1) a USD $3.9 million project to sustain atoll biodiversity and improve natural resources management of critical conservation areas, [lxvii] a (2) USD $852,00 biennial report regarding GEF funding, [lxviii] and (3) a USD $125,00 chemical and waste management assessment. [lxix]

The types of projects for which the RMI has received funds have been specific habitability projects that address a concrete adaptation need, like drinking water or coastline protection. However, in order for the RMI to implement long-term adaptation strategies, like constructing an artificial island or designing and planning a resettlement, funding entities must provide the security of a long-term financial commitment. To attract a durable commitment from funders for these kinds of adaptation projects, the RMI must ensure it has the institutional capacity to manage complex investment. In its 2050 Climate Strategy document, the RMI identified its limited institutional capacity and focus on ad hoc projects as a challenge to attracting finance for complex adaptation measures that could take decades. [lxx]

In May 2019, the RMI’s Office of Environmental Planning and Policy Coordination (OEPPC) and Ministry of Finance, together with the Nationally Determined Contributions (NDC) Partnership, met for a climate finance management workshop in Majuro, with participants shown here. [https://ndcpartnership.org/news/marshall-islands-takes-next-steps-national-climate-finance-mechanism]

Overcoming these challenges will require the RMI to create internal governance and reporting structures to manage large-scale investments over a long period. The SIDS Accelerated Modalities of Action (SAMOA) Pathway is a UN General Assembly initiative designed to help SIDS develop greater investment capacity. [lxxi] In addition, the RMI could blend mitigation and adaptation project investment portfolios to better distribute incentives and risks across an array of adaptation and mitigation projects. [lxxii]

Conclusion

A variety of adaptation and funding options are available to the RMI, each of which have associated benefits, challenges, and open questions of applicability.

Finance is currently available for projects that will reinforce the habitability of the RMI’s existing islands, and the GCF is financing coastal infrastructure improvements. If the RMI elects to elevate some of its atolls by building higher ground, it could seek financing from sources that have already proven willing to invest in the RMI’s infrastructure adaptation projects.

Obtaining financing to build artificial islands is less certain, as only national and private investors have financed this type of project thus far. To pursue this type of option, the RMI could attempt to attract similar foreign and private investment, or advocate for funding from the GCF or GEF. Building these structures may still be a cheaper and more preferable option to resettlement if they are a durable long-term strategy in the face of sea-level rise and frequent storms.

Planned resettlement may be considered a backstop, long-term adaptation measure, though it is not widely supported by the Marshallese. The RMI carries a unique historical legacy and contemporary political arrangement that includes a migration provision to the United States. For that reason, the planned resettlement of various communities may or may not be instructive, whether they come from within the Marshallese community (the Bikinian purchase of land in Hawai'i), or from others, such as Kiribati's purchase of land in Fiji, or the re-location of a Maldivian community to another of the country's islands. To date, no resettlement has been funded by public sources of climate finance, making this option financially limited. Further, even if the RMI purchased land elsewhere, the cost of the full relocation would remain. Tackling resettlement as a series of incremental projects from land purchase to gradually building and developing the new area may not be optimal, as later stages could fail to be funded and delays could carry a large social and cultural toll.

Further legal and political options for adaptation may take a number of forms for the RMI, as it navigates numerous scales of climate governance as a group of atolls, a country, a freely associated state, and a member of regional and international coalitions. At minimum, the RMI could encourage a broader definition of adaptation that would include long-term measures like artificial island construction and resettlement, through their National Adaptation Plan, membership in AOSIS and other coalitions, and possible engagement with reparative justice under international law. Multilateral entities and development banks may be more willing to finance these options if they are seen as true adaptation solutions. In the face of ongoing climatic and geopolitical change in the Pacific, the RMI will likely need to maintain or renegotiate its existing associations and funding structures, consider the role of local and regional projects and community-based adaptation initiatives, [lxxiii] and anticipate the best ways to fund Marshallese adaptation going forward.

Source: Kees van der Geest

REferences (ENDNOTES)

[1] The MICMP notes the possibility that lack of freshwater, extreme heat, or the concurrence of multiple climate impacts may remove or thoroughly compromise the viability of livelihoods on the RMI, and thus habitability , before the actual loss of territory. Based on continued research on coastal morphology (including processes of accretion), physical territory may remain, yet its quality could necessitate near complete resettlement. For further information, please see Storlazzi, C. D., Gingerich, S. B., van Dongeren, A., Cheriton, O. M., Swarzenski, P. W., Quataert, E., ... & McCall, R. (2 018). “Most atolls will be uninhabitable by the mid-21st century because of sea-level rise exacerbating wave-driven flooding.” Science Advances 4(4): eaap9741 and Stege, M. H. (2 018). “Atoll habitability thresholds.” In Leal Filho, W., & Nalau, J. (eds). Limits to Climate Change Adaptation, pp 381-399. Cham, Switzerland: Springer.

i See generally Kevin Morris, Maxine Burkett & Brittany Lauren Wheeler, The Marshall Islands Climate Mitigation Project, Climate-Induced Migration and the Compact of Free Association (COFA): Limitations and Opportunities for the Citizens of the Republic oF the Marshall Islands 6 (2019), https://rmi-migration.com/cofa-policy-brief-1 [https://perma.cc/PU5E-2562].

ii See Giff Johnson, Marshall Islands plans to raise islands to escape sea level rise, Radio New Zealand (February 25, 2019), available at https://www.rnz.co.nz/international/pacific-news/383299/marshall-islands-plans-to-raise-islands-to-escape-sea-level-rise

iii See Vince Beiser, Aboard the Giant Sand-sucking Ships that China Uses to Reshape the World, MIT Tech. Rev. (Dec. 19, 2018), https:// www.technologyreview.com/2018/12/19/103629/aboard-the-giant-sand-sucking-ships-that-china-uses-to-reshape-the-world/ [https:// perma.cc/PRZ6-PCCD] [hereinafter Beiser, Aboard].

iv United Nations Convention on the Law of the Sea art. 55–57, Dec. 10, 1982, 1833 U.N.T.S. 397 [hereinafter UNCLOS]; Miguel Esteban & Lillian Yamamoto, Atoll Island States and International Law, 121–25 (2014). An island is technically defined as a “naturally formed area of land, surrounded by water, [and] above water at high tide.”

v Nicholas C. Kraus, Shore Protection Structures, in Encyclopedia of Coastal Science 875, 877 (Maurice Schwartz, ed., 2005).

vi Esteban & Yamamoto, Atoll Island States, supra note 4, at 121–25.

vii Intergovernmental Panel on Climate Change (IPCC), Small Islands. Climate Change 2007: Impacts, Adaptation and Vulnerability. Contribution of Working Group 2 to the Fourth Assessment Report of the Intergovernmental Panel on Climate Change 694 (Nobuo Mimura, et al., eds., Cambridge U. Press 2007), https://www.ipcc.ch/site/assets/uploads/2018/02/ar4-wg2-chapter16–2.pdf [https:// perma.cc/E6WN-424Y].

viii Esteban & Yamamoto, Atoll Island States, supra note 4, at 152.

ix See, e.g., Adaptation Planning Support Helps Countries Weather Climate Change, Green Climate Fund, https://www.greenclimate.fund/ stories/adaptation-planning [https://perma.cc/XC5R-LQ4Y]. See also Republic of the Marshall Islands Joint National Action Plan for Climate Change Adaptation & Disaster Risk Management 2014-2018, available at https://pafpnet.spc.int/attachments/article/782/RMI-JNAP-CCA-DRM-2014-18.pdf.

x FP066, Green Climate Fund, https://www.greenclimate.fund/project/fp066 [https://perma.cc/7CM6-ZZCJ].

xi UNCLOS, supra note 4, at art. 56.

xii Sally Brown et al., Land Raising As a Solution to Sea-level Rise: An Analysis of Coastal Flooding on an Artificial Island in the Maldives, 13 J. Flood Risk Mgmt. 1, 2 (2020) [hereinafter Sally Brown et al., Land Raising].

xiii Fabrizio Bozzato, Dryland: Artificial Islands as New Oceanscapes, 17 J. of Futures Stud. 1 (2013), https://jfsdigital.org/wp-content/ uploads/2013/10/174-A01.pdf [https://perma.cc/S2PQ-SXDT]; See also Nick Rigillo, Copenhagen is Building a New Island to Help Fix its Housing Shortage, Bloomberg Bus. (Oct. 5, 2018), https://www.bloomberg.com/news/articles/2018-10-05/booming-copenhagen-set-to-expand-with-new-residential-island [https://perma.cc/6WPS-LY56]

xiv See generally Philip G. Dabbagh, Compacts of Free Association-type Agreements: A Life Preserver for Small Island Sovereignty in an Era of Climate Change?, 24 Hastings Envtl. L. J. 431, 451-52 (2018) [hereinafter Dabbagh, Compacts of Free Association-type Agreements].

xv Eric Hirsch, It Won’t Be Any Good to Have Democracy if We Don’t Have a Country: Climate Change and the Politics of Synecdoche in the Maldives, 35 Global Envtl. Change 190, 195 (2015).

xvi Dabbagh, Compacts of Free Association-type Agreements, supra note 14, 451-52 n.117–19; see also Zeenat Saberin, What’s Behind Saudi-UAE Aid to Maldives? Al Jazeera (Mar. 1, 2018),https://www.aljazeera.com/indepth/features/saudi-uae-aid-maldives-180228130657644.html [https://perma.cc/4KEJ-YSUV] [hereinafter Saberin, Saudi-UAE Aid to Maldives].

xvii Id. See also MDP Warns of ‘Creeping Colonialism’ by Saudi Arabia, Maldives Indep. (Mar. 4, 2017), https://maldivesindependent.com/ politics/mdp-warns-of-creeping-colonialism-by-saudi-arabia-129169 [https://perma.cc/U9BS-JMKS]. Saberin, Saudi-UAE Aid to Maldives, supra note 16.

xviii Sally Brown et al., Land Raising, supra note 12, at 9. xix See Jon Letman, Rising Seas Give Island Nation a Stark Choice: Relocate or Elevate, National Geographic (November 19, 2018), available at https://www.nationalgeographic.com/environment/2018/11/rising-seas-force-marshall-islands-relocate-elevate-artificial-islands/#close

xx Jennifer J. Marlow & Lauren E. Sancken, Reimagining Relocation in a Regulatory Void: The Inadequacy of Existing US Federal and State Regulatory Responses to Kivalina’s Climate Displacement in the Alaskan Arctic, 7 Climate L. 290, 305 (2017) [hereinafter Marlow & Sancken, Reimagining Relocation]; Elizabeth F erris, U.N. High Comm’r for Refugees, Protection and Planned Relocations in the Context of Climate Change 32 (2012), http://www.unhcr.org/5024d5169.html [https://perma.cc/ECM8-GMH2]

xxi Press Release, Climate Change, Office of the President of the Republic of Kiribati (2014),http://www.climate.gov.ki/2014/05/30/ kiribati-buys-a-piece-of-fiji/ [https://perma.cc/KP67-GFH9]; see also Maxine Burkett, Lessons from Contemporary Resettlement in the South Pacific, 68(2) J. Int’l Aff. 75 (2015), https://pdfs.semanticscholar.org/b364/b2307ed949662af2e29082f2adc494964834.pdf [https:// perma.cc/A44P-Q2RA] [hereinafter Burkett, Lessons from Contemporary Resettlement].

xxii Burkett, Lessons from Contemporary Resettlement, supra note 21.

xxiii Id.

xxiv See “ Why Bikini Islanders Bought Land On The Big Island” (2019). Available at https://www.civilbeat.org/2019/05/chad-blair-why-bikini-islanders-bought-land-on-the-big-island/

xxv S. Rep. No. 106-240 (1999).

xxvi Press Release, U.S. Dept. of the Interior, Interior Authorizes Full Decision-Making Power to Bikini Leaders over Annual Budget of the Bikini Resettlement Trust Fund (Nov. 28, 2017), https://www.doi.gov/oia/interior-authorizes-full-decision-making-power-bikini-leaders-over-annual-budget-bikini [https://perma.cc/388F-PPSV].

xxvii See generally U.S. Gov’t Accountability Office, GAO-18-415, COMPACTS OF FREE ASSOCIATION: Actions Needed to Prepare for the Transition of Micronesia and the Marshall Islands to Trust Fund Income (2018), at 22, https://www.gao.gov/assets/700/692707.pdf.

xxviii Dabbagh, Compacts of Free Association-type Agreements, supra note 14, at 456; Kevin Morris, Maxine Burkett & Brittany Lauren Wheeler, The Marshall Islands Climate Mitigation Project, Climate-Induced Migration and the Compact of Free Association (COFA): Limitations and Opportunities for the Citizens of the Republic oF the Marshall Islands 6 (2019), https://rmi-migration.com/cofa-policy-brief-1 [https://perma.cc/PU5E-2562].

xxix See Damien Cave, Why Did a Chinese Diplomat Walk All Over People on a Pacific Island?, N.Y. Times, Aug. 19, 2020, https://www. nytimes.com/2020/08/19/world/asia/kiribati-china.html?action=click&module=News&pgtype=Homepage [https://perma.cc/UL4L-A8TT]; Ashley Westerman, Some Pacific Island Nations Are Turning To China. Climate Change Is A F actor, NPR, Nov. 23, 2019, https://www.npr. org/2019/11/23/775986892/some-pacific-island-nations-are-turning-to-china-climate-change-is-a-factor [https://perma.cc/4S3X-QBQW].

xxx See Ama Francis, Sabin Ctr. for Climate Change Law, Columbia Law Sch., Free Movement Agreement & Climate-Induced Migration: A Caribbean Case Study ii (2019), https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3464594 [https://perma.cc/T94M-ARX8].

xxxi Autumn Skye Bordner, Climate migration and self-determination, 51 Colum. Hum. Rts. L. Rev. 183, 183-248 (2019).

xxxii Autumn S. Bordner, Caroline E. Ferguson, and Leonard Ortolano, Colonial dynamics limit climate adaptation in Oceania: Perspectives from the Marshall Islands, 61 Glob. Environ. Change, 102054 (2020).

xxxiii The Warsaw International Mechanism for Loss and Damage was established in 2 013 at the Conference of the Parties (COP) 19 in Warsaw, Poland. It addresses loss and damage (“adverse effects”) that are associated with climate change.

xxxiv Emma Allen, Climate Change and Disappearing Island States: Pursuing Remedial Territory, 1 Brill Open Law 1 (2018).

xxxv IPCC, Climate Change 2014: Mitigation of Climate Change: Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change 1211 (2014) (defining ‘climate finance’ as the financial resources devoted to addressing climate change globally and to financial flows to developing countries to assist them in addressing climate change). See also United Nations Framework Convention on Climate Change, art. 4(8)(g), May 9, 1992, S. Treaty Doc. No. 102-38, 1771 U.N.T.S. 107, [hereinafter UNFCCC].

xxxvi See UNFCCC Standing Committee on Finance, 2018 Biennial Assessment and Overview of Climate Finance Flows Technical Report (2018); Climate Finance Regional Briefing: Small Island Developing States (2019), https://climatefundsupdate.org/ publications/climate-finance-regional-briefing-small-island-developing-states-2019/ [https://perma.cc/S5AY-9X2L].

xxxvii Padraig Oliver et al., Climate Policy Initiative, Global Climate Finance: An Updated View, 3 (Nov. 2018), https:// climatepolicyinitiative.org/wp-content/uploads/2018/11/Global-Climate-Finance-_-An-Updated-View-2018.pdf [https://perma.cc/EZ9N- 7JK5].

xxxviii Id. at 3; UNFCCC Standing Committee on Finance, 2018 Biennial Assessment and Overview of Climate Finance Flows Technical Report 9 (2018) (renewable energy, energy efficiency, and sustainable transportation are primary areas of mitigation investment).

xxxix UNFCCC Standing Committee on Finance, 2018 Biennial Assessment and Overview of Climate Finance Flows Technical Report 96 (2018); UNEP, The Adaptation Finance Gap Report 2016 xii (2016).

xl See UNFCCC, supra note 34, art. 4(3).

xli Id. See also Alexander Zahar, Climate Change Finance and International Law, 37–38 (2018); What is the Financial Mechanism? What are the Other Funds?, UNFCCC: Climate Get the Big Picture, http://bigpicture.unfccc.int/content/climate-finance/what-is-the-financial-mechanism-what-are- the-other-funds.html [https://perma.cc/7PP6-AV3G] [hereinafter Zahar, Climate Change Finance].

xlii Clive Mutunga, Population, Reproductive Health and International Adaptation Finance 16 (2013), https://pai.org/wp-content/uploads/2013/06/CCFinancingReportFIN.pdf [https://perma.cc/8HYL-9MQR].

xliii Donors and MDBS, Climate Investment Fund, https://www.climateinvestmentfunds.org/finances [https://perma.cc/KJ5P-B6JK].

xliv Zahar, Climate Change Finance, supra note 40, at 39.

xlv Watson & Schalatek, Climate Finance Regional Briefing , supra note 36, at 2.

xlvi Id.

xlvii Jabal Hassanali, COP 25 – AOSIS Closing Statement, Alliance of Small Island States (Dec. 12, 2015), https://www.aosis. org/2019/12/15/cop-25-aosis-closing-statement/ [https://perma.cc/9JL8-6WCX].

xlviii Id.

xlix The AOSIS advocates for cross-cutting initiatives for the Climate Action Summit. See AOSIS/L/No. 12/2019 available at https://www.aosis.org/wp-content/uploads/2019/09/SIDS-Package-Letter-from-AOSIS-Chair-to-UNSG.pdf.

l For an overview of private climate finance, see Remco Fisher et al., UNEP, Demystifying Private Climate Finance (2014), https://www.unepfi.org/fileadmin/documents/DemystifyingPrivateClimateFinance.pdf [https://perma.cc/V8WM-ZR7C].

li See Adapt Now: A Global Call for Leadership on Climate Resilience, Global Comm’n on Adaptation (Sept. 13, 2019), https://cdn.gca. org/assets/2019-09/GlobalCommission_Report_FINAL.pdf [https://perma.cc/YC7N-QYEW], 1, 52–57.

lii Zahar, Climate change finance, supra note 40 at 3; Aaron Atteridge & Nella Canales, Climate Finance in the Pacific, (Stockholm Envtl. Inst., Working Paper No. 2017-04, Jan. 25, 2017), https://mediamanager.sei.org/documents/Publications/Climate/SEI-WP-2017- 04-Pacific-climate-finance-flows.pdf [https://perma.cc/74QC-JLUU].

liii See Atteridge & Canales, supra note 51, at 9–10.

liv Id., at 9.

lv Id.

lvi GCF in Small Islands Developing States (small island states), Green Climate Fund (Mar. 15, 2020), https://www.greenclimate.fund/ sites/default/files/document/gcf-factsheet-sids.pdf [https://perma.cc/4FN4-SN24].

lvii Green Climate Fund, Readiness and Preparatory Support Guidebook 4 (2018), https://www.greenclimate.fund/sites/default/ files/document/guidelines-readiness-and-preparatory-support-guidebook.pdf [https://perma.cc/2X29-RZAB].

lviii

Watson & Schalatek, Climate Finance Regional Briefing , supra note 36, at 2.

lix Id. at 1.

lx Id.

lxi See Marshall Islands, Green Climate Fund, https://www.greenclimate.fund/countries/marshall-islands [https://perma.cc/9QTJ-YNYD].

lxii See FP112: Addressing Climate Vulnerability in the Water Sector (ACWA) in the Marshall Islands, Green Climate Fund, https://www. greenclimate.fund/project/fp112 [https://perma.cc/74BM-ZGSB].

lxiii See FP066: Green Climate Fund, supra note 16.

lxiv See Marshall Islands, Green Climate Fund, supra note 69.

lxv Atteridge & Canales, Climate Finance, supra note 51, at 52.

lxvi Id. (Fig. A9: Sources of finance, sectoral distribution and policy objectives, Marshall Islands).

lxvii See R2R Reimaanlok Looking to the Future: Strengthening Natural Resource Management in Atoll Communities in the Republic of Marshall Islands Employing Integrated Approaches (RMI R2R), Global Env’t Facility, https://www.thegef.org/project/r2r-reimaanlok-looking-future-strengthening-natural-resource-management-atoll-communities [https://perma.cc/VK9E-27PK].

lxviii See Third National Communication and First Biennial Update Report, Global Env’t Facility, https://www.thegef.org/project/third-national-communication-and-first-biennial-update-report-0 [https://perma.cc/P5FW-B2GG].

lxix See Development of a Minamata Initial Assessment in Marshall Islands, Global Env’t Facility, https://www.thegef.org/project/ development-minamata-initial-assessment-marshall-islands [https://perma.cc/3EHH-SC6C].

lxx See Tile Til Eo, Republic of the Marsh. Is., 2050 Climate Strategy “Lighting the Way” (2018), https://unfccc.int/sites/default/ files/resource/180924%20rmi%202050%20climate%20strategy%20final_0.pdf [https://perma.cc/4D9B-VPEA].

lxxi Strengthening the Capacity in Developing, Monitoring and Reviewing Durable Partnerships for Small Island Developing States, U.N. Sustainable Dev. Goals Knowledge Platform, https://sustainabledevelopment.un.org/sids/partnerships2018 [https://perma.cc/NLH4- XSWT].

lxxii Inv. Group on Climate Change, From Risk to Return: Investing in Climate Change Adaptation 2 (2017), https://igcc.org.au/ wp-content/uploads/2017/03/Adaptation_FINAL.pdf [https://perma.cc/N5A9-LZBY].

lxxiii McNamara, K.E., Clissold, R., Westoby, R. et al. An assessment of community-based adaptation initiatives in the Pacific Islands. Nat. Clim. Chang. 10, 628–639 (2020). https://doi.org/10.1038/s41558-020-0813-1 https://www.nature.com/articles/s41558-020-0813-1

![In August 2019, the Asian Development Bank held a conference on Resilient Atoll Nations in Productive Oceans in the Maldives, with participants shown here. [For image and press release on the event, see: https://perma.cc/E4R9-VAVN]](https://images.squarespace-cdn.com/content/v1/596d5a162e69cf240a0f043b/1612917349535-G7IM3M4IR6V1OBLZWGP9/atollnations.JPG)

![This graphic was first published in the factsheet, GCF spotlight: Small Islands Developing States (SIDS) [Available for download at: https://www.greenclimate.fund/document/gcf-small-islands-developing-states-factsheet]](https://images.squarespace-cdn.com/content/v1/596d5a162e69cf240a0f043b/1612988393869-05OMDBJHU083S41O2TGT/GCFPortfolio.JPG)